**Debt accumulation**: Without correct planning, it's potential to build up more debt than supposed.

**Debt accumulation**: Without correct planning, it's potential to build up more debt than supposed.

**Impact on credit score score**: Missing payments or defaulting could lead to long-lasting harm to your credit rating.

**High curiosity rates**: If you have a low credit score, you may be subject to excessive charges which may result in vital reimbursement amou

n Yes, there are a number of alternatives to low-credit loans, together with credit score unions, peer-to-peer lending platforms, and personal lines of credit score. Some non-profit organizations might offer assistance programs or grants to help those in monetary need. It's essential to explore all options earlier than deciding on a l

Choosing the best kind of private mortgage is crucial, as every serves completely different financial needs. Consider your long-term financial strategy and current repayment capabilities earlier than decid

**Origination fees**: Charges for processing the mortgage application.

**Prepayment penalties**: Fees for paying off the loan early, which some lenders impose to secure their anticipated curiosity earnings.

**Late cost fees**: Charges incurred for lacking payment deadli

n Improving your possibilities of securing a low-credit mortgage includes ensuring you've some form of revenue and demonstrating your capability to repay the

Loan for Women. Providing collateral or a co-signer can even enhance your loan application. Additionally, having a clear plan for a way you will use the funds may be persuasive in the software proc

Exploring Bepick for Unemployed Loans

Bepick serves as a complete

Recommended Resource site for people seeking info on unemployed loans. The platform offers detailed reviews and comparisons of various lenders, serving to potential debtors make informed selections. By leveraging Bepick’s intensive database, customers can efficiently study the conditions and offerings of various mortgage products tailored specifically to unemployed peo

Another threat is the potential for falling into a cycle of debt. Individuals who take out loans while unemployed may wrestle to repay them, leading to extra borrowing or extended debt. It's crucial for borrowers to plot a sensible budget and reimbursement technique to avoid exacerbating their financial situat

How to Choose the Right Low-Credit Loan

Selecting the best low-credit mortgage entails careful consideration. Borrowers should analysis different lenders, examine rates of interest, and evaluate the entire value of borrowing. It’s also essential to read the nice print relating to fees and penalties related to missed funds. Utilizing assets like BePick might help borrowers make knowledgeable comparisons between options available to them in the mar

The key benefit of utilizing a cell loan service is comfort. Borrowers can entry funds without having to go to a financial institution department or spend hours filling out paperwork. However, it’s important to grasp the phrases and situations completely, as some cellular loans may include high-interest ra

Low-credit loans are a lifeline for individuals who discover themselves in precarious financial situations, typically due to past credit score points or a scarcity of credit history. These loans provide important funding for wants ranging from private emergencies to consolidating debt. Understanding the benefits and challenges related to low-credit loans can empower borrowers to make informed decisions. Resources like BePick offer detailed insights and reviews on numerous lending options obtainable for low-credit borrowers, guaranteeing that individuals can efficiently navigate their financial journ

Choosing the best lender for a further mortgage includes researching numerous options, comparing interest rates, phrases, and charges. It’s also necessary to contemplate the customer service popularity of the lender and skim evaluations from previous debtors. Utilizing web sites like Be픽 can present priceless insights and facilitate informed decision-making in deciding on the right len

Typically, Mobile Loans cater to various wants, together with personal loans, medical bills, schooling prices, and even emergency funds. These loans often have flexible reimbursement phrases and might range from small quantities to bigger sums, relying on the lender's polic

n When contemplating a low-credit mortgage, key factors embrace rates of interest, repayment phrases, and any extra fees. Borrowers must also assess the lender's reputation and customer service high quality. It’s beneficial to read other customers' reviews to gauge their experiences earlier than making a c

Mobile Loans vs. Traditional Loans

When comparing cellular loans to traditional loans, several variations become obvious. Mobile loans are designed for quick entry and convenience, allowing debtors to navigate the process entirely via their cellular units. In distinction, conventional loans usually require in-person meetings and a more extended software course

여성을 위한 알바구인: 효과적인 구인공고의 세계

여성을 위한 알바구인: 효과적인 구인공고의 세계

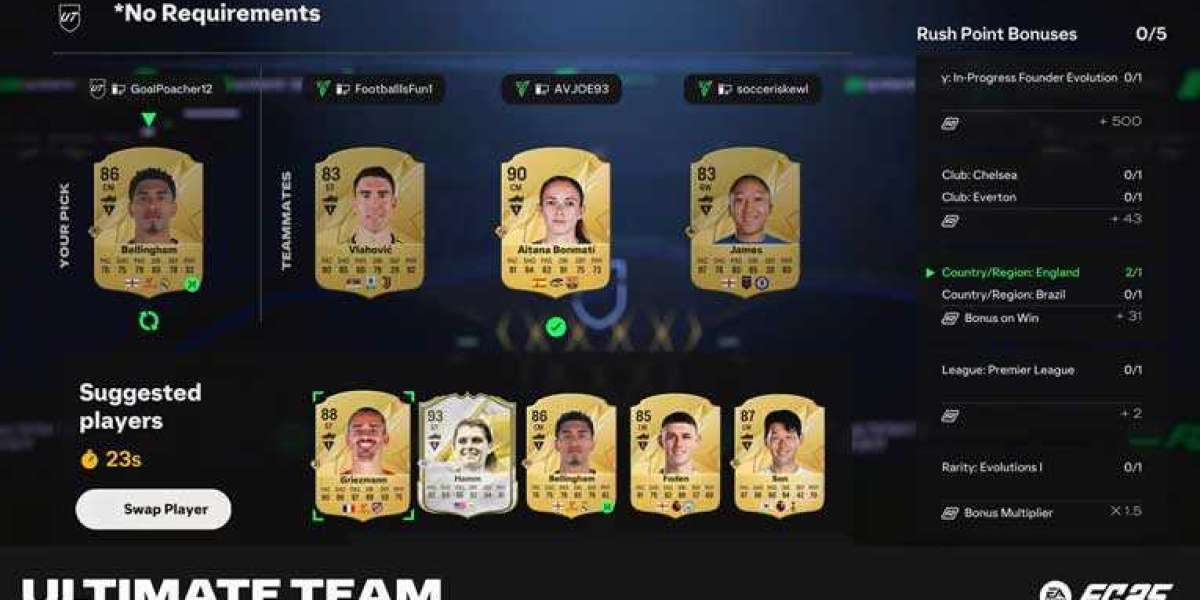

Los 12 Laterales Derechos con Mejor Calificación en EA FC 25

By Ethann

Los 12 Laterales Derechos con Mejor Calificación en EA FC 25

By Ethann Discover the Fast and Easy Loan Solutions with EzLoan Platform

Discover the Fast and Easy Loan Solutions with EzLoan Platform

Effortless Access to Fast and Easy Loans with EzLoan Platform

Discovering Safe Gambling Sites with Sureman: Your Go-To Scam Verification Platform

Discovering Safe Gambling Sites with Sureman: Your Go-To Scam Verification Platform