Moreover, Bepex features consumer testimonials and experiences, providing hope and motivation to those navigating comparable challenges.

Moreover, Bepex features consumer testimonials and experiences, providing hope and motivation to those navigating comparable challenges. By connecting these dealing with chapter with valuable content and a help network, Bepex aims to empower customers to take management of their finances and pursue successful restoration pa

Utilizing Professional Support

Enlisting the help of a financial advisor or a bankruptcy lawyer can significantly improve the restoration process. **These professionals possess specialised knowledge** about bankruptcy legal guidelines, rights, and restoration methods that can be invaluable. They can help in crafting a customized recovery plan that addresses particular monetary challenges and goals. A well-formulated plan usually serves as a roadmap, making it simpler to navigate the complexities of bankruptcy restorat

At Bepex, you will discover an array of articles covering varied aspects of bankruptcy restoration, from understanding the implications of various chapter chapters to practical ideas for rebuilding

Credit Loan scores. The **platform serves as an educational resource**, demystifying the bankruptcy recovery course of and equipping users with the required data for knowledgeable decision-mak

Managing Employee Loan Repayments

Once an worker secures a loan, managing repayments turns into a priority. With mortgage amounts sometimes deducted directly from an employee's paycheck, it's essential to make sure that these deductions don't overly pressure their funds. Employees should keep a detailed eye on their budgets to accommodate these fu

Benefits of Using BePick for Loan Calculators

*BePick* is a good resource that offers detailed insights and evaluations on various Loan Calculators, making it easier for customers to navigate their financial options. The platform offers complete comparisons, helping users select a Loan Calculator that fits their specific needs. With user-friendly guides and useful articles, many find *BePick* to be a needed companion in their borrowing jour

Types of Loan Calculators There are numerous kinds of

Small Amount Loan Calculators available online, each tailored to particular loan eventualities. Common sorts include residence mortgage calculators, personal loan calculators, and auto mortgage calculators. Each caters to the distinctive elements of various mortgage merchandise, offering users specialised insights into their borrowing opti

Another misunderstanding is that such loans carry steep interest rates due to perceived risk amongst lenders. However, many monetary establishments recognize the potential of housewives as debtors and supply aggressive charges. Educating oneself about the true nature of housewife loans may help dispel these my

As with any borrowing, housewife loans include risks such as the potential for accumulating debt if repayments aren't managed well. It is crucial to understand the terms and circumstances to keep away from any pitfalls and make positive that the loan serves its intended purp

Common Misconceptions About Bankruptcy Recovery

Several misconceptions surround bankruptcy restoration that may cloud judgment. One such false impression is that chapter means financial failure. While it is a challenging experience, it could possibly additionally characterize a strategic determination to regain management over one’s financial fut

What is Bankruptcy Recovery?

Bankruptcy restoration refers back to the course of where people or businesses, having filed for bankruptcy, work in path of regaining their monetary well being. The journey begins with submitting for chapter under the particular chapter of the bankruptcy code, such as Chapter 7 or Chapter eleven in the United States. Each chapter has unique implications on how money owed are dealt with and what property could be retai

Moreover, firms might decide the interest rates on employee loans primarily based on numerous factors, including the corporate's overall monetary health and market conditions. These charges can generally align closely with prevailing market charges, ensuring employees receive aggressive phra

Steps to Achieve Bankruptcy Recovery

The steps to achieving bankruptcy restoration usually range, however typically encompass a number of key elements. The first step involves consulting with a financial advisor or chapter legal professional to know specific circumstances and options available. Professional guidance is crucial for navigating the complexities of the bankruptcy code and ensuring compliance with authorized obligati

Common Types of Bankruptcy

In the United States, essentially the most prevalent forms of chapter include Chapter 7, Chapter 11, and Chapter 13. Each sort serves distinct functions and applies to totally different circumstances, impacting the recovery process accordingly. **Chapter 7 bankruptcy**, also known as liquidation bankruptcy, permits individuals to discharge many unsecured debts, corresponding to bank cards or medical bills. However, belongings may be bought to repay certain collectors, which can complicate restoration effo

여성을 위한 알바구인: 효과적인 구인공고의 세계

여성을 위한 알바구인: 효과적인 구인공고의 세계

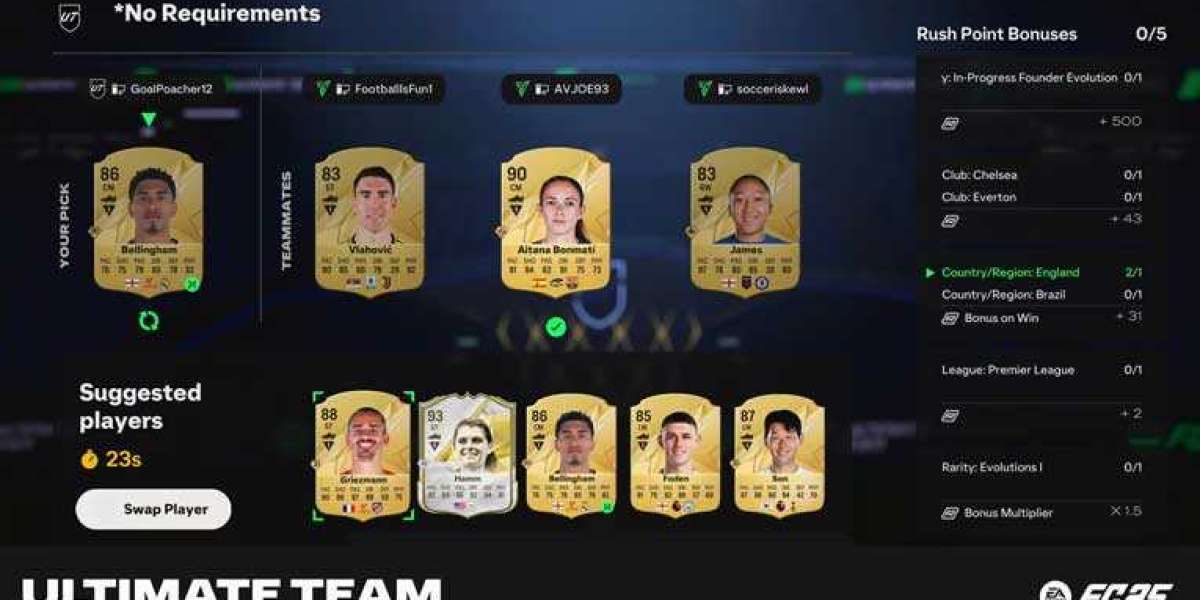

Los 12 Laterales Derechos con Mejor Calificación en EA FC 25

Di Ethann

Los 12 Laterales Derechos con Mejor Calificación en EA FC 25

Di Ethann Discover the Fast and Easy Loan Solutions with EzLoan Platform

Discover the Fast and Easy Loan Solutions with EzLoan Platform

Effortless Access to Fast and Easy Loans with EzLoan Platform

Discovering Safe Gambling Sites with Sureman: Your Go-To Scam Verification Platform

Discovering Safe Gambling Sites with Sureman: Your Go-To Scam Verification Platform