Emergency Fund Loans are designed to supply financial help throughout surprising conditions.

Emergency Fund Loans are designed to supply financial help throughout surprising conditions. These loans serve as a safety internet for individuals dealing with sudden expenses similar to medical emergencies, automotive repairs, or surprising job loss. When confronted with such conditions, having access to quick and reliable funds can alleviate stress and help you regain monetary stability. In this article, we'll explore the concept of emergency fund loans, their advantages, how to apply for them, and supply an introduction to Be픽, a valuable useful resource for these in search of detailed information and critiques on this mat

Understanding No-document Loans

No-document loans are monetary products that enable debtors to obtain funds without providing intensive documentation to confirm their income or employment status. These loans could be interesting for various causes. First, they provide a quicker utility course of for the explanation that ordinary data corresponding to tax returns, pay stubs, and bank statements are not required. This velocity can be crucial for individuals in pressing need of c

Impact of Defaulting on Loans

Defaulting on student loans can have dire penalties, together with damaged credit score scores, wage garnishment, and the loss of eligibility for future federal pupil assist. Understanding the seriousness of mortgage default should encourage debtors to stay informed about their compensation choices and search help if they are struggling to satisfy cost deadli

Look for lenders with positive critiques and transparency regarding their charges and loan phrases. A respected lender ought to clearly clarify their course of and be keen to communicate with potential borrowers about any questions or considerati

Regular communication with workers about the availability of loans and their phrases can additionally be crucial. By making certain that staff are aware of this useful resource, employers can enhance

visit this site system's effectiveness and utilizat

Unsecured loans, nevertheless, don't require any collateral however often include larger rates of interest, as lenders assume more danger. Personal loans and bank cards usually fall into this class. Borrowers should weigh the risks and benefits associated with every kind earlier than continu

What are Emergency Fund Loans?

Emergency Fund Loans are short-term monetary solutions provided to individuals who need quick entry to cash. These loans typically have a fast approval process, making them a gorgeous choice for many who cannot anticipate conventional loans. They can be used for various pressing expenses, similar to medical bills, residence repairs, or even to cover momentary unemployment. The key characteristic of those loans is their velocity and accessibility, which make them ideal for financial emergenc

Unlike commonplace loans that may require intensive paperwork, emergency fund loans are sometimes obtainable through online lenders, credit score unions, or banks. They often come with larger interest rates, reflecting the danger related to lending funds quickly. Thus, it’s important to assess your ability to repay these loans promptly to avoid accruing more d

Types of Credit Loans There are numerous kinds of credit loans available, every catering to specific financial wants and objectives. The most common sorts include personal loans, home equity loans, and bank ca

Potential Drawbacks of

Emergency Loan Fund Loans While emergency fund loans could be helpful, additionally they include potential drawbacks. The most important concern is the excessive rates of interest associated with these loans. Borrowers might find themselves in a cycle of debt if they can not repay the mortgage promptly, resulting in additional charges and better total reimbursement quantit

Yes, taking out small loans can have an result on your credit rating. When you apply for a

Monthly Payment Loan, a tough inquiry could also be made on your credit report, which can decrease your rating quickly. However, making well timed repayments can improve your credit rating over t

Visitors to BePick can find a wealth of resources, together with articles, suggestions, and success stories that highlight the experiences of people who've utilized employee loans. This content material helps demystify the borrowing process, offering sensible advice and guidance primarily based on real-life conditions. Whether you’re an employer trying to implement a loan program or an worker contemplating your options, BePick serves as a dependable information to creating knowledgeable monetary choi

Differences Between Secured and Unsecured Loans

Understanding the differences between secured and unsecured loans is crucial in making an knowledgeable borrowing decision. Secured loans require collateral; within the occasion of default, the lender has the right to seize the collateral to get well losses. Common examples embody residence fairness lo

여성을 위한 알바구인: 효과적인 구인공고의 세계

Tarafından christal14r89

여성을 위한 알바구인: 효과적인 구인공고의 세계

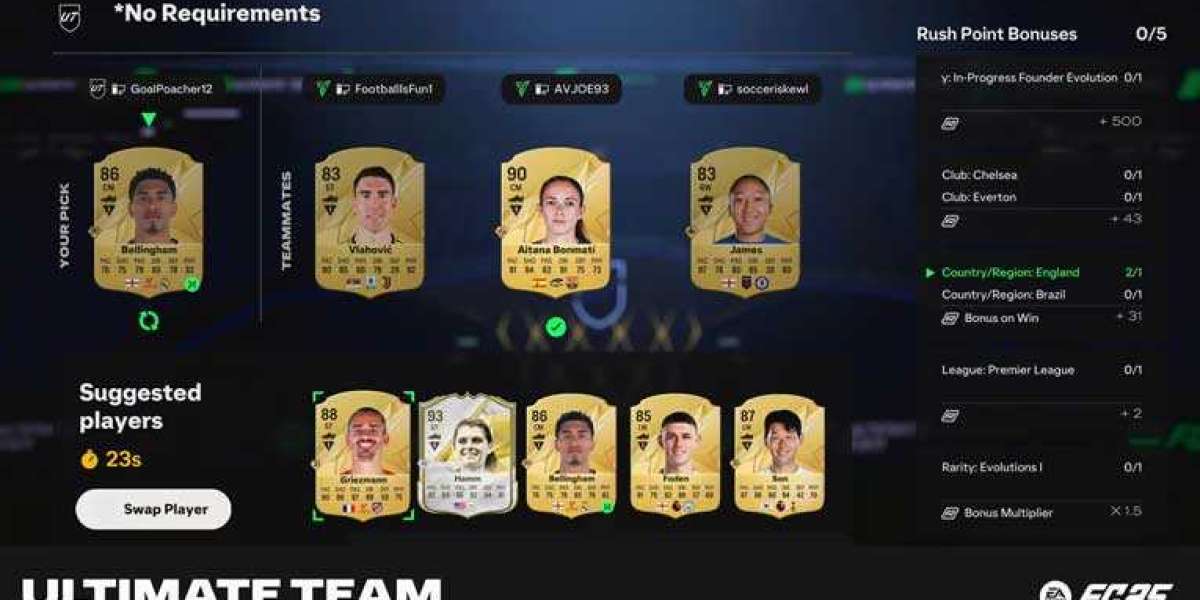

Tarafından christal14r89 Los 12 Laterales Derechos con Mejor Calificación en EA FC 25

Tarafından Ethann

Los 12 Laterales Derechos con Mejor Calificación en EA FC 25

Tarafından Ethann Discover the Fast and Easy Loan Solutions with EzLoan Platform

Tarafından laureneschultz

Discover the Fast and Easy Loan Solutions with EzLoan Platform

Tarafından laureneschultzEffortless Access to Fast and Easy Loans with EzLoan Platform

Tarafından beckyfossey995 Discovering Safe Gambling Sites with Sureman: Your Go-To Scam Verification Platform

Tarafından randiboas11961

Discovering Safe Gambling Sites with Sureman: Your Go-To Scam Verification Platform

Tarafından randiboas11961