Additionally, many lenders on this sector present flexible compensation choices, allowing borrowers to choose terms that greatest match their monetary situation, albeit often with higher interest.

Additionally, many lenders on this sector present flexible compensation choices, allowing borrowers to choose terms that greatest match their monetary situation, albeit often with higher interest rates. This flexibility may be crucial in sustaining financial stability whereas settling mortgage obligati

Unlike conventional loans that analyze credit score scores and histories, no credit examine loans focus on different components, corresponding to income, employment standing, and generally even checking account activity. This method can facilitate a quicker approval process; nonetheless, it usually comes with higher interest rates and fees, reflecting the elevated threat for lend

Types of No Credit Check Loans

The marketplace for no credit verify loans contains numerous varieties, every with its distinctive features. One of the commonest is a payday loan, which presents borrowers a small quantity due on their next payday. Despite their accessibility, they typically carry exorbitant charges that may lure people in a debt l

Another common kind is payday loans, designed for those who need immediate funds till their next paycheck. These loans often come with greater rates of interest and ought to be approached with warning. For those looking to set up or expand a enterprise, online enterprise loans provide quick financing options with competitive rates of inter

The loans often include greater interest rates compared to conventional borrowing options. Therefore, it’s important for borrowers to evaluate their monetary situation before continuing. Understanding the phrases and situations is essential to avoiding pitfalls associated with quick funding lo

The most significant advantage of immediate choice loans is pace. In conditions the place instant funding is critical, corresponding to medical emergencies or urgent repairs, this quick access could be invaluable. Additionally, the less stringent credit score standards make these loans accessible to a broader view

If funds turn into tight, borrowers should discover choices like renegotiating phrases with the lender and even looking for financial counseling. Open communication with lenders can typically lead to more flexible compensation methods, preventing the scenario from escalating into a larger financial downs

Additionally, there is the danger of coming into a debt cycle. Borrowers who cannot meet reimbursement schedules may resort to taking additional loans to cover earlier

Personal Money Loan owed, leading to escalating monetary burd

While instant determination loans may be convenient, they do come with dangers, such as high rates of interest. Borrowers should ensure they totally understand the mortgage terms and choose respected lenders to attenuate the danger of fraud and guarantee fair practi

Why Do People Choose No Credit Check Loans?

Individuals typically resort to no credit verify loans because of financial emergencies or surprising bills. Examples embrace medical payments, automotive repairs, or urgent home repairs. In conditions where traditional loans could also be inaccessible, these loans provide a lifel

Once the application is submitted, lenders evaluate the information, usually utilizing automated methods to expedite decision-making. Many on-line lenders can approve functions within minutes and disburse funds inside a day or two, making this course of incredibly environment frien

Before applying for a fast funding

Loan for Delinquents, assess your monetary wants and reimbursement capabilities. Review different lenders' terms, together with rates of interest and charges. It's additionally important to look at the implications of borrowing, similar to potential debt cycles and short compensation phra

Through user-friendly tools and informative articles, BePick goals to simplify the method of understanding payday loans for single moms. With a concentrate on empowering financially deprived individuals, BePick fosters a group where customers can discover help and resources to reinforce their financial well-be

The website options user-friendly comparisons of interest rates, fees, and phrases to help individuals determine the best options tailored to their needs. Additionally, BePick offers articles that cover potential pitfalls and benefits associated with no credit examine loans, fostering a greater understanding of the implications of borrow

This efficient software course of not solely saves time but additionally reduces the stress related to in search of loans. Many platforms enable candidates to addContent essential paperwork digitally, streamlining the method additional. Borrowers can count on a confirmation of approval inside minutes, and funds may be deposited into their bank accounts shortly thereaf

BePick goes beyond basic data, providing tools that assist users assess their monetary needs and potential loan options. This resource can empower debtors to make well-informed decisions whereas navigating the usually intricate world of fast lend

여성을 위한 알바구인: 효과적인 구인공고의 세계

Door christal14r89

여성을 위한 알바구인: 효과적인 구인공고의 세계

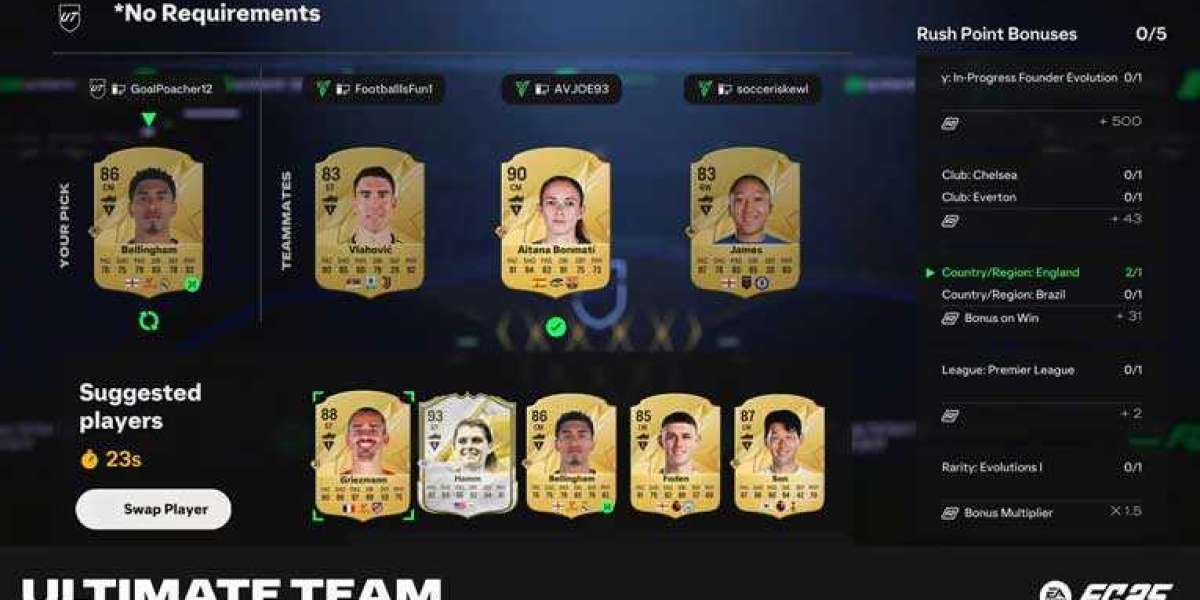

Door christal14r89 Los 12 Laterales Derechos con Mejor Calificación en EA FC 25

Door Ethann

Los 12 Laterales Derechos con Mejor Calificación en EA FC 25

Door Ethann Discover the Fast and Easy Loan Solutions with EzLoan Platform

Door laureneschultz

Discover the Fast and Easy Loan Solutions with EzLoan Platform

Door laureneschultzEffortless Access to Fast and Easy Loans with EzLoan Platform

Door beckyfossey995 1xbet Promo Code for Nigeria: UBASO - Up to ₦600,000 Welcome Bonus

Door virginiahilder

1xbet Promo Code for Nigeria: UBASO - Up to ₦600,000 Welcome Bonus

Door virginiahilder